While gross profit might suggest strong performance, companies must also consider „below the line“ costs when analyzing profitability. Under absorption costing, which is required for external reporting under generally accepted accounting principles (GAAP), a portion of fixed costs is assigned to each unit of production. For example, if a factory produces 10,000 widgets and pays $30,000 in rent for the building, a $3 cost would be attributed to each widget under absorption costing. In other words, the GPP allocates the directly assignable cost of production before capturing the profit. Additionally, it calculates the gross profit made from each dollar of revenue.

What is the approximate value of your cash savings and other investments?

To calculate your gross profit, subtract that cost from your sales revenue. In the world of finance, understanding key performance indicators is vital to assess a company’s health and profitability. One such metric, gross profit, plays a pivotal role in evaluating a business’s financial performance. Net income is often called „the bottom line“ because it resides at the end of an income statement.

Gross Profit vs Gross Profit Margin

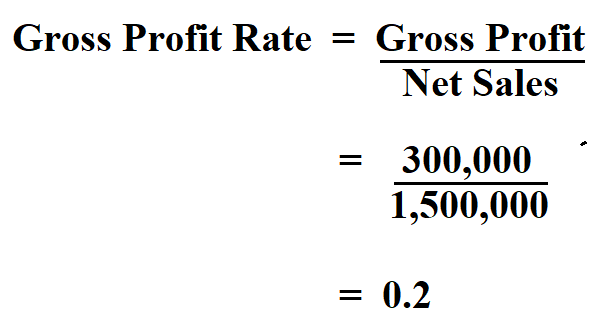

In simple terms, gross profit margin shows the money a company makes after accounting for its business costs. This metric is usually expressed as a percentage of sales, also known as the gross margin ratio. A typical profit margin falls between what you can and cant write off with business travel 5% and 10%, but it varies widely by industry. Gross profit percentage equation is used by the management, investors, and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales.

Gross Profit Percentage vs Gross Margin

- Thus, this unit profit calculated for a product helps firms assess how effective their expenditure is when it comes to the production of goods and items.

- Gross profit helps understand the dollar value of the income that a company brought in.

- The gross profit ratio (or gross profit margin) shows the gross profit as a percentage of net sales.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

Conceptually, the gross income metric reflects the profits available to meet fixed costs and other non-operating expenses. For businesses operating internationally, currency exchange rate fluctuations can impact gross profit percentage when consolidating financial statements. Many businesses experience seasonal fluctuations in sales and costs, which can impact gross profit percentages throughout the year. A change in your sales mix can affect your overall gross profit percentage. However, just because marketing expenses and other indirect expenditures aren’t taken into account when determining gross profit doesn’t mean you shouldn’t pay close attention to them as well. Your cash flow is impacted by these „costs of doing business“ just as much as expenses that are directly connected to goods and services.

In the above case, Apple Inc. has reached a gross margin of $98,392 and 38% in percentage form. This 38% gross margin indicates that out of $1 of revenue from net sales, Apple Inc. can make a gross profit of 0.38 cents. To calculate net profit from gross profit, add other non-operating income (like dividend and interest income) and deduct operating and nonoperating expenses (like selling and administrative expenses). Most businesses choose to calculate gross profit as part of their quarterly accounting. Smaller businesses may choose to calculate gross profit monthly so they can adapt more quickly. The right expense-tracking software can help you catch costly production components that may impact your gross profit.

How to Calculate Gross Profit Percentage in 5 Steps

Yes, if the cost of goods sold exceeds the total revenue, a company will have a negative gross profit. The calculation of gross margin can be calculated both un absolute terms or in percentage format. Learn more about what’s included in gross profit and when to calculate gross profit with frequently asked questions about calculating gross profit. Suppose we’re tasked with calculating the gross profit and gross margin of Apple (AAPL) as of its past three fiscal years. Classifying a company’s gross profit as “good” is entirely contingent on the industry that the company operates within and the related contextual details.

To calculate it, one subtracts the cost of goods sold (COGS) from total revenue. In essence, gross profit represents the money a company earns from its core operations, excluding expenses such as marketing, rent, and salaries. Gross profit and gross profit margin will both tell you how successful a company is at covering its production costs.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Since they don’t change much over time, these expenses might be referred to as fixed costs. It is the total amount of income your company generates from the sale of your products or services. It shows you clearly how much money you’re bringing in from your total sales. It does not include the costs of running your business, such as taxes, interest and depreciation. To calculate operating profit margin, subtract the cost of goods sold (COGS), operating expenses, depreciation, and amortization from total revenue. You then express the result as a percentage by dividing by total revenue and multiplying by 100, similar to gross and net profit margins.

It’s a good indication that the company owner should look at any potential weak places if it decreases. It can be rather amazing how insightful and effective such a straightforward technique can be. People who come across the term „gross“ in economics are frequently perplexed by it. The consumer’s gross income is always requested when they apply for a credit card, a bank loan, or when they need to declare their income. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.